Dental insurance: An untapped source of cash flow

Billions of dollars in dental insurance benefits are left unused every year. These benefits can be used for both general maintenance care as well as dental procedures, like root canals or emergency procedures. According to Forbes, only three percent of patients use all of their dental benefits annually, indicating that there is a significant dollar amount of benefits left untapped at the end of December.

Billions of dollars in dental insurance benefits are left unused every year. These benefits can be used for both general maintenance care as well as dental procedures, like root canals or emergency procedures.

According to Forbes, only 3% of patients use all of their dental benefits annually, indicating that there is a significant dollar amount of benefits left untapped at the end of December.

Typically, dental benefits cover 100% of preventative care, 80% of fillings and endodontics procedures, and 50% of major services like crowns and bridges.1 Research indicates that some patients are skipping general cleanings or holding off on necessary procedures due to out-of-pocket costs. This is best demonstrated by a recent study of rural farmers. Results indicated that 73% of covered individuals had out-of-pocket costs and 7% of insured and uninsured respondents took on debt to cover costs.2

For the dentist, these untapped costs represent loss of clinical revenue. Some of the patients who are not using their full coverage could benefit from additional preventive care or interventions, some of which could be completely covered. This article discusses trends in dental insurers and use of dental benefits. Data was collected in accordance with privacy laws and does not include patient or practice identifying information.

More from Alitta Boechler: Dental benefits: Use them or lose them

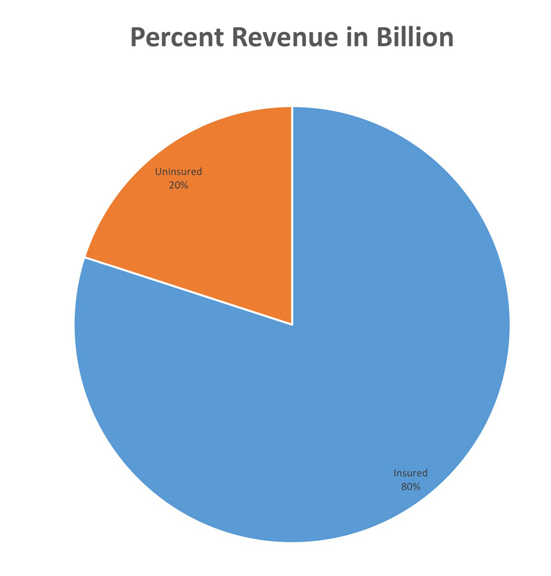

Revenue from insured and uninsured patients

The proportion of revenue that dentists realize, on average, is weighted heavily towards insured patients. Insured patients account for 80% or $17.6 billion of the revenue. Uninsured patients represent 20% of revenue of $4.4 billion in the sample population, a much smaller percentage of dental care revenue.

Insured or uninsured patients may delay care due to financial reasons, however, the vast majority of the insured patients have additional unused coverage. For those attending the clinic but delaying scheduled care, it is easy to discuss options for care and financing oral interventions at their regular appointments.

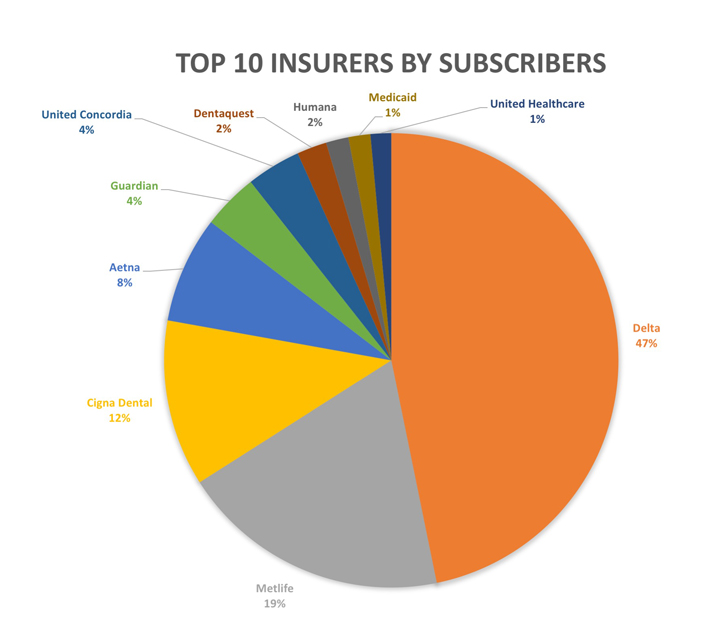

Patient Distribution By Top 10 Largest Insurance Companies

The top 10 insurance companies by number of subscribers represent 50.6% of surveyed patients. This number was determined based on the breakdown of the number of subscribers to each insurance payer in the sample pool. Of the top 10 largest insurers, Delta Dental with 47% of subscribers, MetLife with 19%, and Cigna Dental with 12% lead the field. The rest of the top 10 largest insurers by subscribers each make up less than 10% of the overall industry. Altogether, this indicates that private dental clinics, on average, primarily see insured patients with Delta Dental and MetLife insurance.

More from Alitta Boechler: Key statistics and best trends in dental practice management: 2012-2014

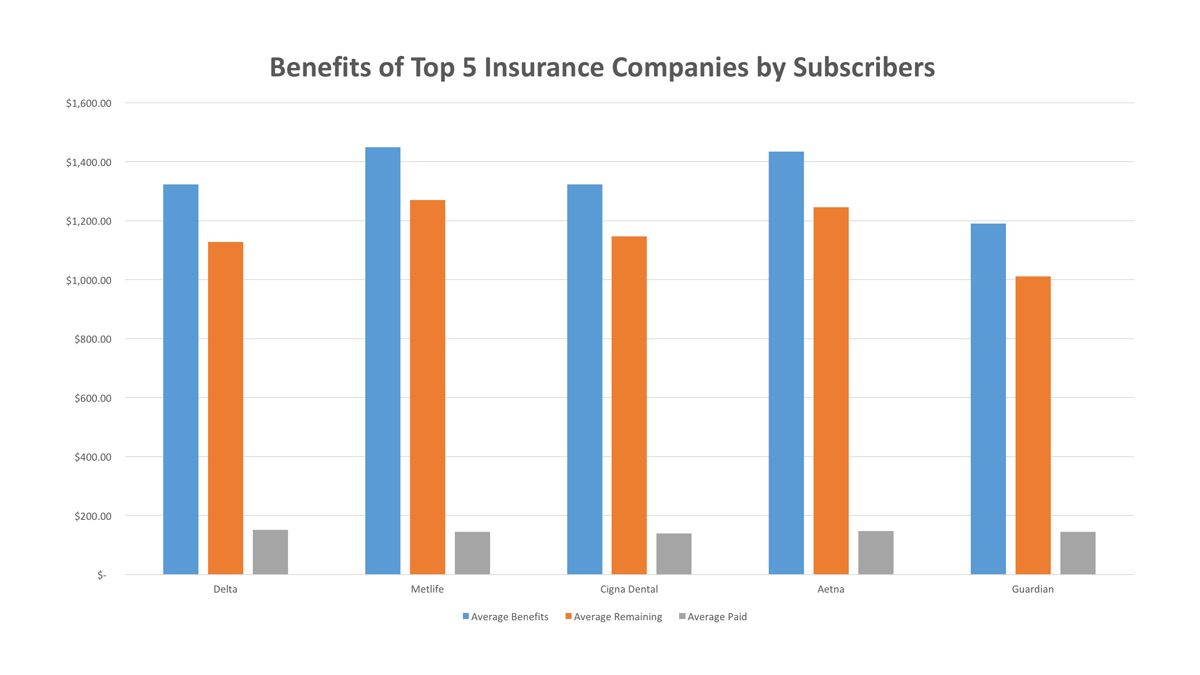

Benefit Distribution

Dental benefits were compared between the top five dental insurance companies by number of subscribers. Data indicated that the average dental benefit was between $1,189.89 for Guardian and $1,449.45 for Metlife. The average subscriber of these companies used only $145.59 or 10.8% of dental benefits. This means that they have an additional benefit of $1,160.55 left over each year.

There are, on average, 2,359 active dental patients in a practice., If only 3% of these patients are using all their benefits, then there are an additional 2,289 patients with benefits remaining. This could account for as much as $2.6 million in revenue left on the table for a practice. Although not all of these patients may require additional dental interventions, if a practice could even convert an additional 5%, they would increase their revenue by $132,825.

For patients with benefits that also require additional dental care, the out-of-pocket costs could be one reason why they are not receiving more dental services. Another possible reason is that patients may not be aware of their benefits or associated costs with getting the dental care they require. To provide these patients with the care they need for good oral health, the office staff will need to educate the patients on the different procedure options and identify hurdles for care. If cost is the issue, be prepared to discuss financing options or other strategies for care delivery.

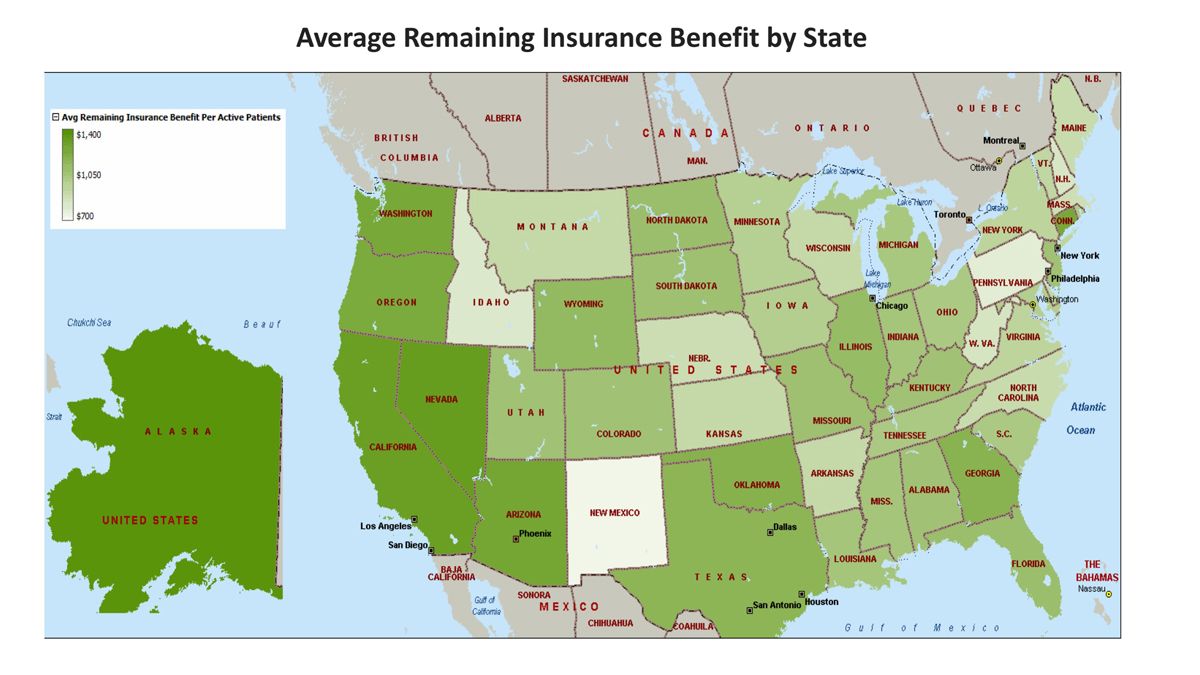

Benefit Distribution By State

There are variations in the amount of benefits left per active patient by state. Patients living in west coast states, including Alaska, California, Arizona, Nevada, Oregon, and Washington, have a comparatively high dollar value of remaining benefits. By comparison, New Mexico, Idaho, and Pennsylvania residents, on average, have few benefits left.

There are a few reasons why certain regions might have additional benefits remaining. In Alaska, Arizona and Oregon, 10 to 20% of the population lives in a dental desert where there is no nearby dental practitioner.3 Another reason might be patients with dual dental coverage, due to coverage from different employers for the same family, using only one plan to pay for coverage.

More on dental insurance: 5 insurance actions you can take now for a smoother 2016

Conclusion

For many patients, 90% of dental benefits are left unused each year, even in the case where further dental care is advised. Dentists have the opportunity to tap into this revenue, increasing practice cash flow, by providing critical dental care to patients.

The key to reaching these patients is to speak with them regarding dental care hurdles when they are in the practice for dental care or for other treatments. Let them know the recommended courses of treatment as well as the amount of benefits they have left over. Also, discuss financing and timing options to give flexibility to those struggling with out of pocket costs, facilitating care delivery.

Active patients in the clinic are potentially underusing their benefits. Reaching out to these patients will improve patient care while providing additional cash flow to the practice. These benefits will grow your practice and help to facilitate the dental care of your community.

References

- diGiacomo, R. (2015). Is dental insurance worth the cost? Bankrate. Retrieved from http://www.bankrate.com/finance/insurance/dental-insurance-1.aspx

- Pryor, C., Prottas, J., Lottero, B., Rukavina, M., & Knudson, A. (2009). The cost of dental care and the impact of dental insurance coverage. The Access Project (4). Retrieved from http://www.rwjf.org/content/dam/web-assets/2009/04/the-costs-of-dental-care-and-the-impact-of-dental-insurance-cove

- Childress, S. (2012, June 26). Do you live in a “dental desert”? Check our map. Frontline. Retrieved from http://www.pbs.org/wgbh/pages/frontline/health-science-technology/dollars-and-dentists/do-you-live-in-a-dental-desert-check-our-map/