Seasonality and effects on accounts receivable in the dental practice

Accounts receivable is often a significant part of a dental practice’s financial health. Due to common dental benefit practices and late patient payments, dentists are often owed a significant amount of money. Although carrying an accounts receivable balance is common and in many cases unavoidable, reducing the outstanding financial burden can improve cash flow and overall practice health.

Accounts receivable is often a significant part of a dental practice’s financial health. Due to common dental benefit practices and late patient payments, dentists are often owed a significant amount of money.

Although carrying an accounts receivable balance is common and in many cases unavoidable, reducing the outstanding financial burden can improve cash flow and overall practice health.

Last month’s article on seasonality trends in revenue indicated that busy months included March, April, June and December with lulls in January, February, May, September and November. More information can be found here.

Sikka Software collects national trends data from thousands of dental practices across the nation. Data is collected in accordance with privacy laws, is free of practice and patient information and is HIPAA and HITECH compliant. Dentists can find out more information by clicking here.

Related reading: How seasonality affects revenue in the dental practice

Seasonality trends

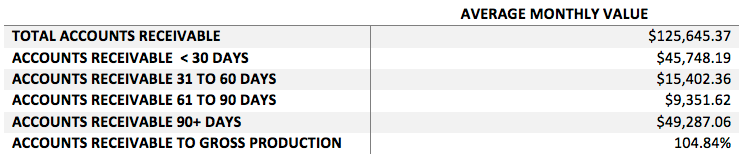

2015 seasonality trends were calculated by tracking the average monthly values of accounts receivable statistics for benchmarking purposes. Total accounts receivable per month averaged $125,645 and represented, on average, almost 105 percent of gross production monthly. This indicates that many practices are carrying high accounts receivable costs.

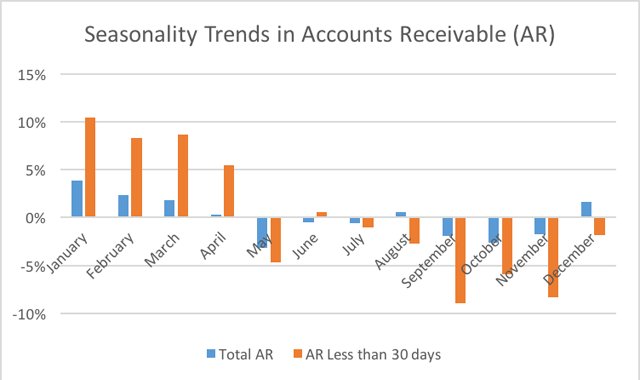

This paper examines accounts receivable under 30 days, as this metric will be more fluid and subject to seasonality trends. The analysis was completed by comparing each month’s national average value to the average monthly value for the entire year. These results are then compared to overall accounts receivable costs.

Results indicate that accounts receivable balances are highest in the winter and early spring months, when patients are carrying high balances. This may because of two factors. The first is that in the short term, patients may be low on cash due to the holiday season. The second is that patients have just received new dental benefits for the year and so more insurance benefit payments are due.

More from the author: 5 ways to stop revenue-killing attrition in your dental practice

Conclusion

High accounts receivable balances are typical and are part of doing business with dental benefit providers. However, large balances that go unpaid, either by practice error, insurance dispute, patient refusal or inability to pay may create a large burden on the practice.

Karrie Sullivan, Chief Marketing Officer at TSI said:

"Managing accounts receivable in a busy dental practice is challenging. Clients that use Dental Collect from Sikka and TSI are able to make a significant dent in past due balances, often with 97 percent return on investment on recovered accounts."

Sikka Software and TSI have tools to track and manage accounts receivable and seasonality. Dentists can find out more by clicking here or by attending our annual Summit in Monterey, CA. This is a great opportunity to learn how to use practice data and analytics while meeting industry experts and gaining CEUs. More information is available here.