New names and technology, but the challenges in dentistry are still the same

Ever since I started working with dentists in the early 1980s (and undoubtedly well before), there have been “megatrends” in dentistry, just as there are in any profession. In the early 1980s, a sampling of trends included:

Economic We were recovering from a recession, mired in extraordinary inflation, a monetary policy that saw Prime Rate hit 21.5%, double-digit unemployment, and an unprecedented number of bankruptcies.

Professional The dental profession was in upheaval with the advent of changes to long-standing professional practices: proliferation of auxiliary staff performing procedures previously restricted to licensed dentists; denturism; dental service advertising; pre-paid dental plans, including PPOs and HMOs; and shopping center and franchise dentistry, to name a few.

Medical With the AIDS epidemic came the need for new infection control protocols.

Fast forward to today. Surprisingly (or not) dentistry faces many of the same familiar themes. Just search the Internet for “Recession-Proof Your Dental Practice,” and you will see what I mean.

Economic There’s government regulation galore, and, of course, our most recent Great Recession still peering at us in the rearview mirror.

Professional Cost challenges remain, this time related to third-party reimbursements, staffing challenges, skyrocketing educational costs, and positioning one’s quality practice amidst ever-evolving alternative business models.

Medical Even as dentists must run their businesses, they face the additional hurdle of remaining leading edge in comprehensive diagnosis and treatment planning and the general delivery of great service and top dentistry.

The whole thing reminds me of our most recent presidential debate season. From Obama/Romney back to Kennedy/Nixon and onward through Clinton/Bush, it can be surreal how the same issues are forever resurfacing: the economy, high taxes, high unemployment, big government, and the need for “change” in Washington. It’s surreal.

Technology and economics

So, yes, many of the concerns faced by the dental profession today are similar to those of decades past. At the same time, many have evolved and amplified even logarithmically. First, there’s been the dizzying advances in technology, where everything moves faster, for better and worse. In addition, we’ve been facing deeper economic peaks and valleys. Historically, dentistry has been fairly resilient during economic downturns, but consider that the average length of a recession since World War II was about 11 months. Under those averages, it was possible to tell yourself and your team, “How bad can it get?” That changed with The Great Recession which, depending on who you ask, lasted more than three times that average. It was a deal-changer for everyone, the dental profession included.

As a dental CPA, I feel particularly qualified to discuss financial and tax issues that are problematic for dentists. Let’s explore some of the biggest concerns that dentists face on these fronts today.

Finance and student debt

For new dentists, I think student debt is their biggest concern these days. I recently helped a new dentist figure out the best of a few options for repaying her private university and dental school student loans totaling $370,000!

I wonder if she can even comprehend the scope of that debt at her young age. Like our national debt of more than $16 trillion, it’s mind-boggling. For every $100,000 borrowed, the monthly payment is $716 (assuming a 6% interest rate and 20-year repayment term). Using a traditional repayment schedule versus an income-based plan, my young dentist would face payments of $2,650 per month. Given that student loan interest is not deductible for single taxpayers earning over $75,000 or married-filing-jointly couples earning over $155,000, she must earn $4,417 each month after taxes, just to make her payments. That is $53,000 per year.

Even if my young dentist is below the deduction phase-out levels, the maximum amount of student loan interest she can deduct is $2,500 per year. Again at 6% over 20 years, the total interest on $370,000 is $266,190. These figures are so daunting it’s perhaps no surprise that young men and women considering dentistry today either put up a mental block on the numbers involved or choose a different profession.

Reimbursements

Another significant problem facing many dentists is the Delta Dental reimbursement reductions we’re currently seeing across the country. The effects are far-reaching. Not only does it impact the cash flow of dental practices that participate in Delta Dental programs, but it is taking its toll on retiring dentists who are suddenly being asked to accept large price concessions depending on their degree of participation. Buyers will be forced to accept lower fees and to participate in Delta’s PPO plans. This could cause more senior dentists to work longer to “earn back” that price concession, much like many had to earn back their deflated retirement dollars after the stock market crash of 2008-2009. This information will work its way into the dental schools, where students may realize that their prospects after graduation are increasingly limited.

Taxes

Another problem facing dentists and all small business owners are increased taxes. For single dentists earning over $200,000 and married-filing-jointly couples earning over $250,000, taxes have now kicked in from the Affordable Care Act (ObamaCare). They include the additional 0.90% High Income Hospital Insurance Tax and the 3.8% Medicare Investment Tax.

There are other ObamaCare taxes that are not tied to income, including:

Fees on pharmaceutical companies

Restrictions (contribution limits) on Flexible Spending Accounts and Health Savings Accounts

A Health Insurance Premium Tax and Excise Tax on Cadillac health plans

There’s also the little-known $2.00 per person/per year tax on all non-government health insurance policies to fund the “Patient-Centered Outcomes Research Institute” a nonprofit corporation which is neither an agency nor establishment of the United States government. The primary purpose of this institute is to provide education and information to patients, clinicians, purchasers and policy makers about health-care decisions.

Dentists should be especially mindful of the 2.6% Medical Device Excise Tax. Manufactures have no choice but to pass this cost along to dentists. Whether dentists will be able to successfully pass this tax through to their patients remains to be seen. This will be a big problem, since just about everything a dentist touches qualifies as a medical device. Additionally, for single dentists earning over $400,000 and married-filing-jointly couples earning over $450,000, the higher taxes under the American Taxpayer Relief and Accountability Act (ATRA) take effect. This means a top federal income tax rate of 39.6% plus the phase-out of personal exemptions and itemized deductions.

Putting the numbers in context

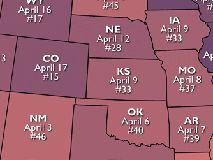

The notion of “Tax Freedom Day” may help put some of these numbers in context. This is the day every year by which Americans have paid all of their taxes. It’s an over-simplified proposition, since it takes all taxes due, and divides them by all taxpayers. Of course, some of us pay considerably more taxes than others. Still, it’s fun to contemplate the big picture it provides in the map, which displays Tax Freedom Day in each state.

An optimistic ending note

It’s important to remain informed about one’s challenges. That way, you can prepare for and make the best of them. At the same time, it’s important to not lose heart, particularly in your role within such a desirable and honorable profession. To quote the unflappable 60 Minutes curmudgeon Andy Rooney, “It’s just amazing how long this country has been going to hell without ever having got there.”

For my part, I am fortunate to be a member of the Academy of Dental CPAs (ADCPA), whose Fall 2013 meeting happened in San Francisco in mid-November. Our purpose at this particular meeting was to discuss and learn as much as we can about the current state of affairs in dentistry, so we can continue to strengthen our ability to support our 6,000 or so dentist clients across the country. We heard from top people in organized dentistry plus industry leaders about the goings on at Delta Dental, the California Dental Association’s pending lawsuit against Delta, possible alternative business models for dentists, and methods to improve dental practices at all levels from proper procedure coding to optimizing hygiene departments, to overhead control and effective marketing strategies.

Thirty years ago, when I started working with dentists and heard the terms PPO and Franchise Dentistry, I ran around like Chicken Little. Today it is the same story, but the names have been changed to IPO and Management Service Organization (MSO). Plus, I’d like to think I’ve learned a thing or two over the years. While dentistry has significant challenges ahead, I believe that the profession is one of resilience and creativity. I, for one, have every confidence that, together, we’ll do what we must to make the necessary appropriate adjustments to remain the same desirable and honorable profession we’ve been all along.