How to Lower Your Taxes on Practice Construction, Renovation

Here's a way to save tens of thousands of dollars on a new build or renovation of a dental practice: the cost segregation study. Instead of writing off construction costs over 39 years, qualifying construction might be written off over five, seven, or 15 years. Make sure your CPA knows how this key savings opportunity works.

It is important that you use a company that specializes in engineered cost segregation studies if you're looking to use this tax-savings method in your dental practice.

You just finished building your dream dental office: eight treatment rooms and brand-new equipment in a great location. Although it was one of your biggest investments it will bring in new patients, allow you to do the dentistry you want to do and make the balance of your dental career enjoyable.

Now that the office is completed, potential income-tax savings will be on your mind. Hopefully, your CPA knows how a cost segregation study works. Here’s an overview for the uninitiated.

Constructing a dental office requires spending in the following categories:

• Dental equipment, computer equipment, furniture, and fixtures. Equipment and computers are depreciated over five years. Furnishings are depreciated over seven years. You also have the option of expensing them under Section 179 up to a maximum of $500,000 per year.

• Leasehold improvements (i.e., structure, plumbing, electrical wiring) and the internal structure of the dental office (i.e., carpet, walls, ceilings). Generally, the structural components of a building are depreciable over 39 years. Qualified improvement property is usually depreciable over 15 years.

Upon reviewing the depreciation schedule of a new client, a dental CPA notes leasehold improvements written off over 39 years and that triggers a recommendation that the client consider a cost segregation study.

Cost segregation studies came about in the 1980s. A company called Hospital Corporation of America was advised by its accountants, engineers and attorneys that instead of writing off the cost of the majority of their hospitals over 39 years, the company should come up with a method to “segregate” portions of the construction costs that could be written off over five, seven or 15 years.

The Internal Revenue Service (IRS) audited Hospital Corporation of America and disallowed the segregation of the costs, taking the company to court. Several times.

And the IRS lost.

The IRS acquiesced, subsequently creating rules regarding exactly how an engineered cost segregation study must be prepared and documented, giving birth to the cost segregation industry.

Cost segregation studies can be used when a tenant builds out an office, or when a dentist builds or buys a new building. They can even be used by a dentist who built an office anytime after 1987 (yes, that’s correct —1987).

Here’s an example: In 2016, for $1.2 million, the fictional Dr. John Jones purchased a free-standing building, a shell in which he then built a dental office. The project cost him

$2 million, not including the cost of equipment, furnishings or computers. Dr. Jones then set up a separate limited liability company (LLC) to own the building, which then rents the building to the J Corporation, the operator of his practice.

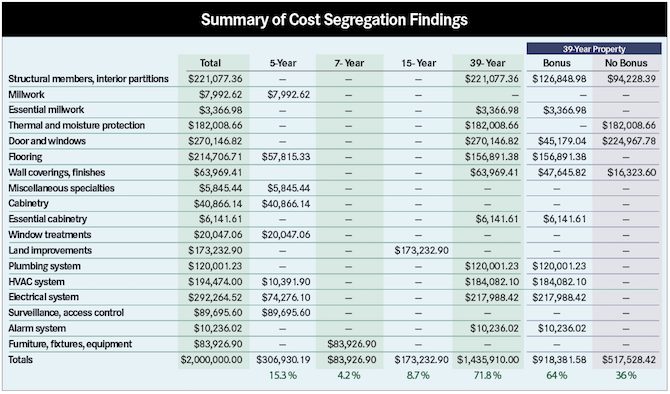

Dr. Jones has a sharp CPA who suggests performing an engineered cost segregation study. Bill Sheridan, principal of Cost Segregation Consultants in San Diego, California, and J. Curt Gautreau, who is a certified cost segregation professional from Baton Rouge, Louisiana, provided the sample you see above of a cost segregation study for a $2 million building.

As you can see, out of the $2 million, which would have normally been depreciated over 39 years, 15.3 percent is depreciated over five years, 4.2 percent over seven years, 8.7 percent over 15 years, and the balance of 71.8 percent over 39 years. Depending on the situation, this could save tens of thousands of dollars in income tax in the first year.

Had the entire project cost of $2 million (assume this is the cost of the building and improvements, and that land costs were additional) been depreciated over 39 years, the first year’s depreciation deduction would have been $2 million divided by 39, or $51,282.

With the cost segregation study, the amount of depreciation allowed is as follows in year one:

• Of the five-year property ($306,930), Dr. Jones can deduct 50 percent bonus depreciation ($153,465); he can also deduct 20 percent of the remaining $153,465, or $30,693. Total deduction: $184,158.

• Of the seven-year property ($83,927), he can deduct 50 percent bonus depreciation ($41,963); he can also deduct 14.29 percent of the remaining $41,963, or $5,997. Total deduction: $47,960.

Assuming the 15-year property qualifies as a qualified improvement property under Internal Revenue Code Section 168(k)(3), this, too, qualifies for 50 percent bonus depreciation. So, of the $173,233 allocated to 15-year property, Dr. Jones can take $86,617 in bonus depreciation and $8,662 in additional depreciation for a total of $95,279 in year one.

Finally, he receives depreciation on $1,435,910 over 39 years, which comes to $36,818 per year.

So, the total first-year depreciation deduction with the cost segregation study is $364,215, compared with a first-year deduction of $51,282 without a cost segregation study. This gives Dr. Jones an additional depreciation deduction of $312,933, which, at a 40 percent marginal tax rate (federal and state), saves him $125,173 in taxes.

Now let’s assume Dr. Jones built the exact same building in 1999 and has filed tax returns through 2016. Federal tax law states that he can have a study done for his 2017 returns, file the proper paperwork with the IRS, and make a retroactive adjustment to his tax return, called a Section 481(a) adjustment. In 2017, he can take a one-time deduction based on the difference between the depreciation he would have taken had he done the study in 1999 and the amount he has taken without the study.

In this case, had he done the study in 1999, he would by this time have taken all of the depreciation on the five-year property of $306,930; on the seven-year property of $83,927; on the 15-year property of $173,233; and seventeen-thirty-ninths of the $1,435,910 taken over 39 years on the structure, which comes to $625,909. So the total amount of depreciation using the cost segregation study numbers is $1,189,999.

Without the study, he has taken depreciation of seventeen-thirty-ninths multiplied by $2 million, which is $871,795. So the difference between the $1,189,999 and the $871,795 is the one-time deduction, which comes to $318,204. At a 40 percent marginal tax rate, that is a one-time savings of $127,282.

If you are planning on building a new office, whether it includes the purchase of a building or not, or if you have built one anytime after 1987 and did not do a study, the implementation of a study can save you tens of thousands of tax dollars.

It is important that you use a company that specializes in performing engineered cost segregation studies. In addition, you have until the due date of your tax return including extensions to have the study prepared plus file the required IRS form, Form 3115.

Finally, if you generate the large depreciation deduction, which throws your Schedule E (this is the form on your personal tax return that will be filed if you own the building in a single-member LLC) into a loss for the year, it is very important that your CPA makes what is called a “grouping election” pursuant to Treasury Regulation Section 1.469-4 on your corporate tax return and on your personal return. This avoids what is called the passive activity loss rules, which would disallow the loss created from the depreciation deduction created by the cost segregation study.

Be sure to consult your tax professional about this as the rules are very complex.

Art Wiederman is a CPA and managing partner of Wiederman and Chamberlain, a CPA firm that works with about 250 dentists in Tustin, California. He is a frequent lecturer at local, state and national dental meetings and is a founding member of the Academy of Dental CPAs (ADCPA), which comprises 26 dental CPA firms across the country, servicing more than 9,000 dentists.