How I Took Advantage of a Mega Backdoor Roth IRA Without a High Income

The Mega Backdoor Roth IRA is an investment strategy that allows you to contribute up to 36k per year to your existing Roth IRA in addition to your other retirement savings. The best part is there are no income restrictions. Continue below to learn about Future Proof MD's experience with the investment.

The Mega Backdoor Roth IRA is perhaps one of the best kept investing secrets in retirement planning.

In my March net worth update, I asked for advice on finding a better way to invest the extra money I had from cashing out my individual stock investments. One of my attending physicians suggested I Google something called the Mega Backdoor Roth IRA. After some research on the topic, I decided to take advantage. I'm definitely not the first person to try the Mega Backdoor Roth IRA, but I may be the first who doesn't need to use the "backdoor" since I make so little income. So, I suppose it's really just a Mega Roth IRA for me. Read on to learn more.

RELATED: More Coverage on

- A Guide to Accommodating HIV-Positive Patients in Your Practice

- How to Manage Your Practice's Summer and Back-to-School Schedule

- For Dentists Picking Health Benefits, Uncertainty Looms

BASICS OF THE BACKDOOR ROTH IRA

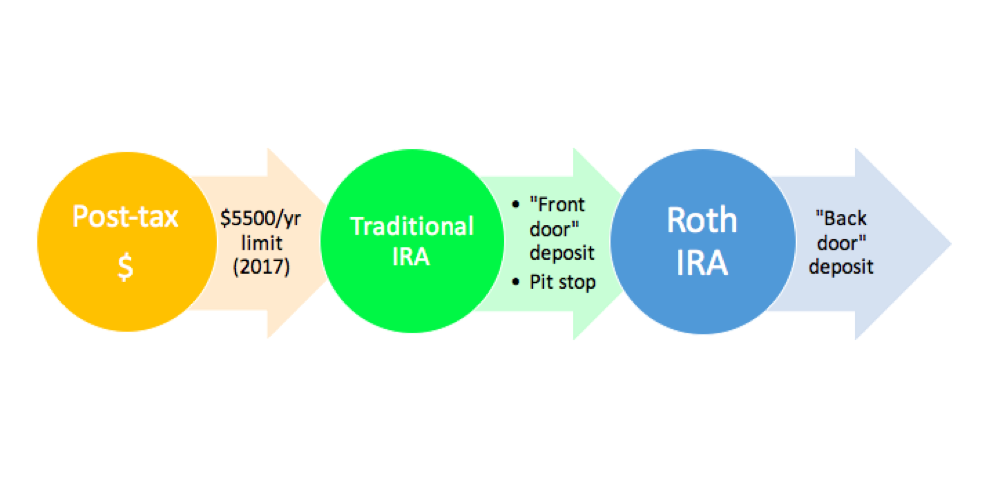

In order to continue this discussion on the Mega Roth IRA, you need some background knowledge about the Roth IRA and the Backdoor Roth IRA. It's called a "backdoor" because it's a roundabout way for people to invest into a Roth IRA account and enjoy its tax benefits despite earning too much income to contribute to one directly. Luckily, there is a wealth of information on both topics available online. I recommend you visit the following resources for an introduction on the topic:

·No source better than the source, the IRS page on Roth IRAs.

·The White Coat Investor teaches you how to do it step-by-step in Backdoor Roth IRA Tutorial.

BASIC IDEA OF A BACKDOOR ROTH

THE MEGA BACKDOOR ROTH IRA

The "Mega" backdoor Roth IRA is made possible by the good graces of the US government and their friendly agents at the IRS. If you want to know what made all this possible, read IRS Notice 2014-54. For a more in-depth discussion, I recommend Michael Kitches' article - IRS Notice 2014-54 Acquiesces On Splitting After-Tax 401(k) Contributions For Roth Conversion.

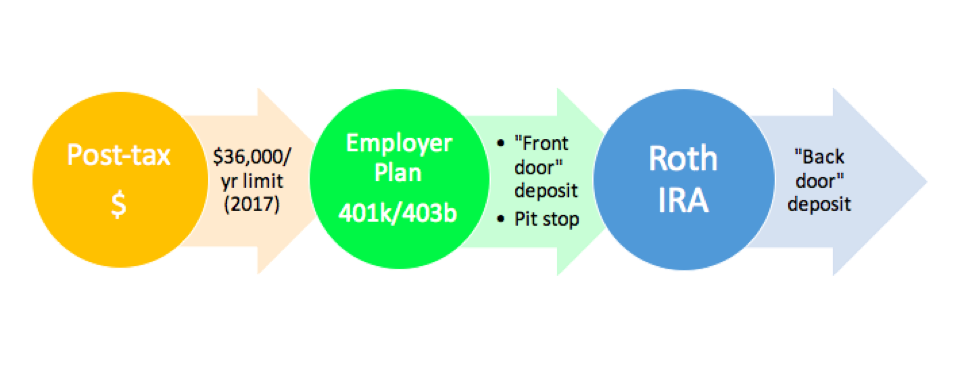

The basic idea is that if you have an employer-sponsored retirement plan such as a 401k or a 403b, you can defer up to $18,000 per year of income into that plan (as of 2017) and take a nice tax deduction — that's called the limit on employee elective deferrals. However, a less commonly known limit is the total annual contributions (annual additions), and that limit is set at $54,000 a year. So, what makes up the difference between that $18,000 and $54,000? That $36,000 is made up of employer-matching contributions (if you're lucky), employer non-elective contributions and allocations of forfeitures. That $36,000 is what makes the Mega Backdoor Roth IRA so attractive.

Let's assume your employer doesn't match and leaves you with all $36,000 of that additional space available. Here is what a Mega backdoor Roth IRA looks like.

BASIC IDEA OF A MEGA BACKDOOR ROTH. YEP, THAT'S $36,000 INTO YOUR ROTH IRA!

For additional reading, here are some great online resources:

·The White Coat Investor - The Mega Backdoor Roth IRA

·Mom and Dad Money - The Mega Backdoor Roth IRA

·Mad FIentist - Mega Backdoor Roth

CAVEATS

The Mega backdoor Roth IRA sounds amazing — and it is. Unfortunately, not everyone can benefit. Here are a couple of key caveats you need to consider:

· Your employer must allow after-tax contributions into its 401k/403b plan.

· The plan must allow for in-service withdrawals of such contributions, meaning you can withdraw while you still work for the same employer, hence "in-service".

If your employer does not offer these features, you should start lobbying your benefits department.

THE FUTURE PROOF MD EXPERIENCE

As it turns out, my employer was kind enough to offer both these features in our 403b plan. Since I have been looking for a tax-efficient way to invest the money from cashing out my stocks, I decided this was going to be my big purchase of the year. This past week, I dropped off a $36k check at my benefits department office. It's a strange feeling because I've never handed over such a large check before in my life. At the same time, I'm convinced I made a good investment in my future financial independence.

Questions & comments? Reach out to me at http://futureproofmd.com/