5 Tips to Assess a Payment Provider’s Billing Practices for Your Dental Practice

How to evaluate terms, rates, and fees (and identify unfair practices) to get the best experience for both your practice and the patients.

5 Tips to Assess a Payment Provider’s Billing Practices for Your Dental Practice. Photo courtesy of Andrey Popov/stock.adobe.com.

There are thousands of merchant services, providers, and payment processors in the U.S. Most promise to lower your rates to win your business. It’s important to look beyond published rates to avoid a potential bait-and-switch scheme that hides extra fees or locks you into a long-term, expensive contract that results in a sub-par experience for you and your patients.

Calculating rates and fees is so complex that many business owners give up trying to decipher the myriad of descriptors and abbreviations on their merchant statements—even though they sense something isn’t fair. Many providers practice unethical billing by padding transaction costs, adding nuisance fees with vague descriptors, and charging early termination penalties.

Let’s open wide and examine some of the most common unfair billing practices.

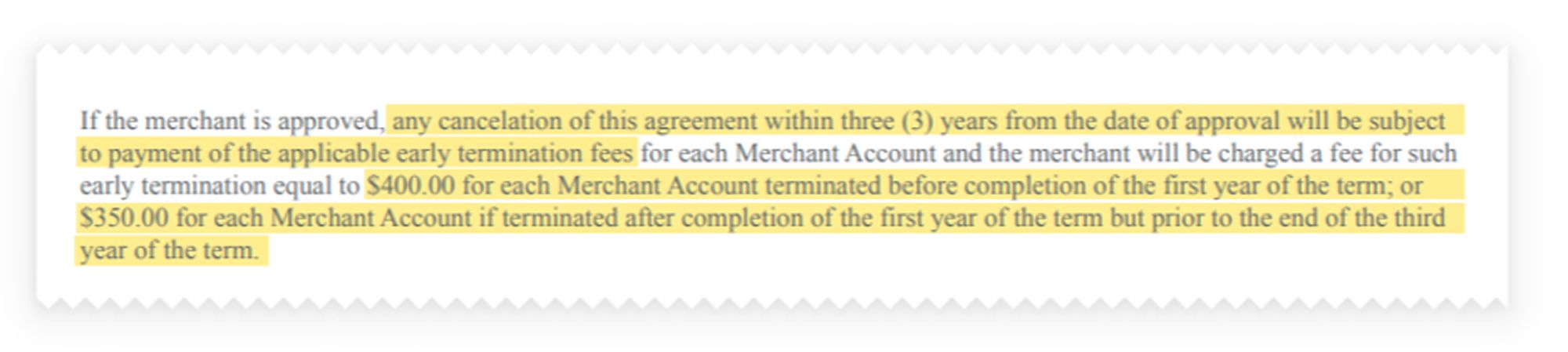

Contract Terms

Beware of providers that expect you to lock into 1-to-5-year contracts before you begin processing. They should earn your business one month at a time and provide a simple termination window, such as a 30-day notice. Read the fine print in your agreement, as some unethical providers will charge early termination fees, or set your account up for auto-renewal. Miss it, and you could be stuck with another year paying too much for substandard service.

Figure 1

An ethical provider with month-to-month terms will allow you to try their service alongside your current provider, compare them, and cancel at any time if you aren't satisfied.

TIP #1: Ask to see contract terms before you start pricing discussions.

Processing Rates

Payment processing rate plans are confusing. There are more than 300 interchange categories managed by the card brands. Providers determine rates above interchange, often as part of a flat or tiered pricing program that blend various rates into groups, which makes it difficult to understand the true cost and determine if you are being ripped off.

Some providers don’t educate customers about best practices, which can result in expensive downgrades because, if they are using bundled or tiered pricing models, they make money in the margins. An ethical provider will identify a pattern of downgrades and recommend best practices to mitigate their occurrence.

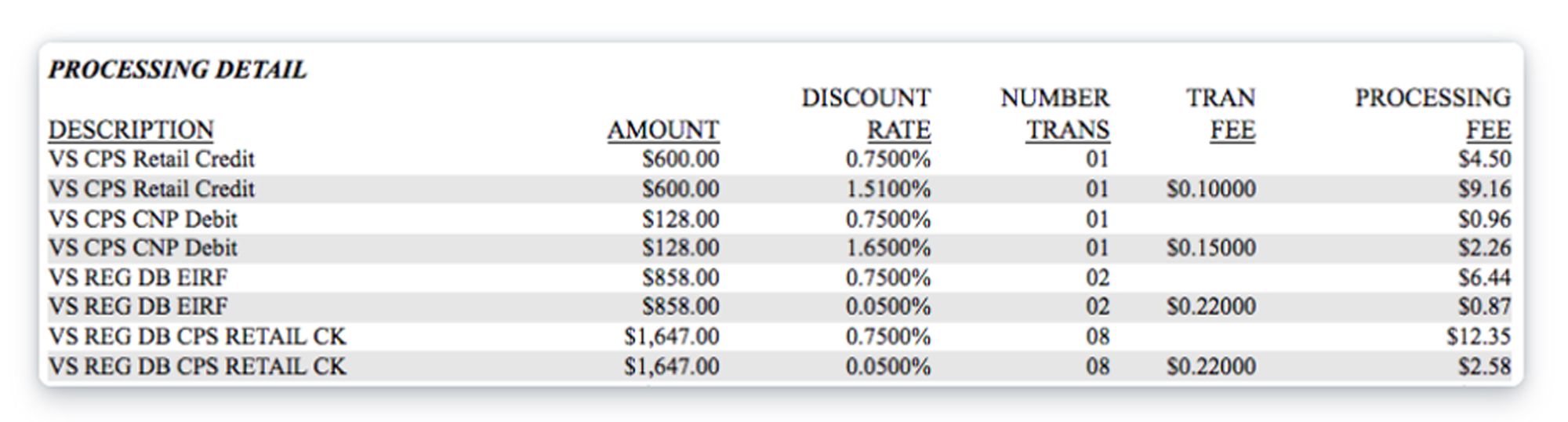

TIP #2: Some providers pad Interchange rates because they know it’s confusing.

Figure 2

↘ Actual rate = 1.65%

TIP #3: Some providers intentionally allow customers to experience downgrades.

Figure 3

Pricing Plans

Inquire which pricing models a provider offers—Interchange plus, Tiered, Flat rate—so that as your dental practice expands, you’re not paying a bundled rate that you’ve outgrown. Interchange plus, when done right, is the most transparent rate plan available. It simply charges the published Interchange cost from the card brands plus a flat markup on each transaction. If you are on a flat pricing program you may not have the ability to graduate to an Interchange plus program.

TIP #4: Ethical providers will separate the mark-up and actual interchange

Figure 4

Unfair nuisance fees - Look for clever made-up fees that your provider uses to pad their pockets. These have nothing to do with processing transactions. Some charge bogus fees that add up to hundreds—or even thousands—of extra dollars per year. The most common include:

- Account setup fees

- PCI and EMV compliance or non-compliance fees

- Statement fees

- IRS tax reporting fees

- Old equipment fees

- Bank service fees

- Next day funding fees

- Customer support fees

TIP #5: Providers love inventing new fees, knowing most customers don’t read their statements.

Figure 5

Straighten Out Payment Acceptance

The good news is that there are ethical providers who have experts that will examine your statements and confirm if the fees and rates seem fair. Many will help you understand how much you could save by eliminating unethical fees, while demonstrating how time-saving features streamline payment acceptance. Find providers that don’t have set-up fees and offer month-to-month terms. Simply run them side-by-side for a month or 2 risk-free and pick the one that is best for your practice.